The green bond market in China – How to grow it and proft by it

Beijing, 24 March 2015 – A landmark report was released today in Beijing on growing a green bonds market in China.

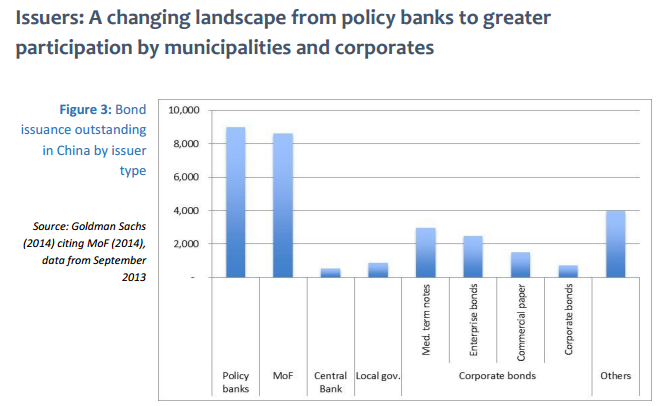

China is committed to reforming its bond markets. This has implications both for financial and economic policy concerns, as well as environmental concerns, as it increases the opportunity to utilize the bond market to finance the transition to a low-carbon/green economy in China.

It also has important implications for investors and technology solutions providers seeking to benefit from the greening of the Chinese economy.

The report, Growing a green bonds market in China: key recommendations for policymakers in the context of China’s changing financial landscape, was developed jointly by the Climate Bonds Initiative, the International Institute for Sustainable Development (IISD) and Renmin University’s Chongyang Institute.

The action-oriented paper was also undertaken in conjunction with the Financial Research Institute of the Development Research Centre of the State Council (DRC-FRI).

It is accompanied by a 5 step “how to” guide for green bond issuers in China that is available in English and Chinese.

Green bonds would be “highly suitable” for green infrastructure projects like environmentally friendly buildings, public transport networks, pollution reduction plans and water systems,

The reports, anchored in the Chinese context, evaluate the current state of play of China’s bond markets and how short-medium term financial reforms may provide an opportunity for green bonds to emerge.

They provide a range of specific, action-oriented recommendations for China’s policymakers on how to grow a green bonds market in China.

These policy options are gaining traction amongst top policymakers in China: many of them are included in recent policy agenda drafts from the China State Council’s Development Research Centre and working groups of the People’s Bank of China.

The reports complement the synthesis paper on Greening China’s Financial System launched at the China Development Forum last week, and offers more detailed recommendations specific to green bonds.

Sean Kidney, CEO of the Climate Bonds Initiative and co-author of the report said: ‘The substantial commitments China has made to reform its bond markets are exciting from a financial and economic perspective, but also from an environmental one, as they increase the opportunity to utilize the bond market to finance the transition to a low-carbon/green economy in China.’

Policymakers are considering how to facilitate green bonds in the design of the market. Pushing ongoing changes in a green direction is much easier than attempting changes to established systems notes the report.

Beate Sonerud, Policy Analyst at the Climate Bonds Initiative noted China is grappling with environmental challenges that are different to those of the mature economies in Europe and the US. “While climate change is high on the agenda in China too, the green challenge here is much broader: for example air pollution, contaminated soil and clean water. Green bonds will be part of the financing solution to those challenges.”

The excellent opportunity to integrate green bond market development with ongoing debt capital market reform is ripe in many emerging markets beyond China, noted Kidney.

“Country specific policy guides for green bonds can assist policymakers that are currently reforming their debt capital markets on how to take advantage of the excellent opportunity to design the bond market for green bonds from day one.”

Highlights from the reports:

- China’s particular environmental challenges and financial system means China-specific definitions for green bonds are recommended. These can build on definitions and standards for green investment already developed by the China Banking Regulatory Commission’s Notice on Filing and Reporting in Green Credit Statistics Forms.

- A new entity, “Green Bond Market Development Committee”, should be set up to review existing and forthcoming green standards and regulations.

- A green bond verification system can use the structure of 3rd party, independent, government approved verification entities used both under the local emissions trading schemes in China and the National Energy Savings scheme. This could include establishing an independent government approved verification supervisory entity for green bonds, and expand the oversight of credit rating agencies and auditors to cover green definitions.

- Establish a central fund to provide partial credit guarantees for green municipal revenue bonds and green public-private partnership project bonds transitioning to full credit transparency. ü Provide corporate tax credits for interest earned on green enterprise bonds (from state owned enterprises), corporate bonds and medium-term notes.

- Establish green investment quotas through the expansion of the programs for foreign investors in the bond market (R-QFII and QFII).

The growth of China’s bond market provides increasing opportunities for companies, government and development banks to close the investment gap for China’s environmental investments, as well as addressing non-environmental concerns such as transparency in the financial system.

Considering how the financial system changes that are already occurring can enable the growth of a green bond market makes it easier and cheaper than making retroactive policy and regulatory changes, notes the report.

About Climate Bonds Initiative:

The Climate Bonds Initiative is an investor-focused not-for-profit. It is the only organization in the world focusing on mobilizing the USD 100 trillion bond market for climate change solutions. The Initiative advises development banks, investors, governments and NGOs about structuring programs to maximize the leverage of public sector resources. More information is available here.

The full report is available here. For Chinese language go to: www.climatebonds.net/china @ClimateBonds