Uncertainties Cloud Canada’s Energy Future

GLOBE-Net, March 2, 2016 – In late January the National Energy Board (NEB) Chair and CEO Peter Watson released Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040.

The report is the only publicly available Canadian long-term energy outlook that includes all energy commodities in all provinces and territories.

Canada’s Energy Future 2016 outlined various projections for higher and lower energy prices, and alternate market access and energy infrastructure assumptions. The Report also explored the long-term implications of these uncertainties.

“Without development of additional oil pipeline infrastructure, crude oil production grows less quickly but continues to grow at a moderate pace over the projection period.” NEB

Highlights:

- Total end-use energy demand increases by an average of 0.7 percent per year to 2040.

- Crude oil price of US$80 per barrel by 2020 and US$105 per barrel in 2040.

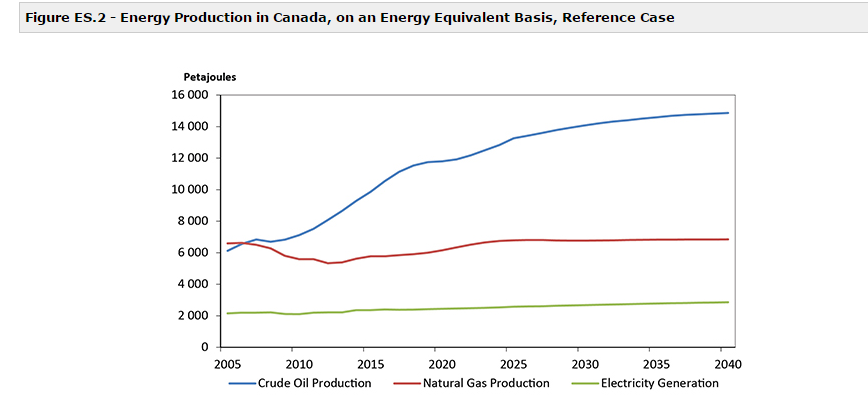

- Without development of additional pipeline infrastructure, crude oil production grows less quickly, but continues to grow at a moderate pace to 2040.

- Future electricity capacity additions are dominated by renewables and natural gas.

- The majority of Greenhouse Gases emitted in Canada are related to fossil fuel consumption.

In the Report’s Reference Case, total energy use grows from 13 444 petajoules (PJ) in 2013 to 16 233 PJ in 2040. The energy intensity of the Canadian economy, measured in energy use per unit of economic activity, continues its declining trend and falls by an average of one per cent per year from 2013 to 2040.

Given the policy and technology assumptions of this analysis, fossil fuels remain the primary source of energy in Canada over the projection period.

This increase in fossil fuel consumption implies that GHG emissions will increase over the projection period, consistent with the most recent GHG emission projections from Environment and Climate Change Canada.

Higher and lower energy prices impact energy use across the economy in different ways. Canada is a major producer of energy and this tends to influence its role as a consumer of energy. Energy use is highest in the High Price Case, reaching 16 659 PJ by 2040.

Slightly higher economic growth and more demand in the oil and natural gas producing sector outweigh the downward impact of higher prices on consumption.

The impact is reversed in the Low Price Case, which has the lowest energy use of the cases at 15 840 PJ in 2040, despite higher consumption outside of the oil and natural gas sector.

“Canada’s energy future will not be determined by a single force, but rather, the interaction of many. We need inclusive discussions about energy, the environment, infrastructure and market access,” said Watson,

“These need to be real conversations between industry, ENGOS, governments, Indigenous Peoples and other Canadians. And they need to be fed by unbiased, reliable, and accessible long-term energy analysis to support common points of understanding.”

The full report is available here. Data Appendices are also available:

- Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 – Appendices – January 2016

- Canada’s Energy Future 2016: Energy Supply and Demand Projections to 2040 – An Energy Market Assessment – Figure Data [EXCEL 15206 KB] – January 2016

- The NEB publishes weekly Market Snapshots that are available on the NEB web site.