Energy taxes misaligned with environmental impacts of energy use

Paris, June 25, 2015 – Governments are under-utilizing taxation as a tool to curb the environmental consequences of energy use, foregoing revenue and weakening their attack on the principal source of greenhouse gas emissions responsible for climate change and air pollution, according to new OECD analysis.

Taxing Energy Use 2015 – OECD and Selected Partner Economies compares taxes on energy use in 41 countries worldwide, which together use 80% of global energy.

The OECD says that taxes on energy use provide a transparent policy signal and are one of the most effective tools governments have for reducing the negative side effects of energy use.

However, the new analysis shows that energy taxes are poorly aligned with the negative side effects of energy use, and are having limited impact on efforts to reduce energy use, improve energy efficiency and drive a shift towards less harmful forms of energy.

“Current taxes on energy use are low and incoherent,” said OECD Secretary-General Angel Gurría.

“Tax policy is not being used effectively to reduce the adverse health impacts and emissions of greenhouse gases resulting from energy use. There is still considerable scope to use taxation to improve the environment and containing climate change.

“The new research presents a systematic, comparative analysis of the structure and level of energy taxes in the 34 OECD member countries and seven G20 economies: Argentina, Brazil, China, India, Indonesia, Russia and South Africa.It translates statutory tax rates into effective tax rates per unit of energy and per unit of carbon dioxide (CO2), for a wide range of energy types and uses.

Click here to see the underlying data |

Taxes on energy use are shown to be low relative to the environmental costs of energy use, both on average and within many countries.

The weighted average effective tax rate on all energy use across the 41 countries is EUR 14.8 per tonne of CO₂ from energy use. This is well below estimates of the social cost of carbon, at around EUR 30 per tonne. When the cost of other negative side-effects from energy use are also considered, this strengthens the conclusion that average tax rates are very low relative to the harmful effects of fuel use.

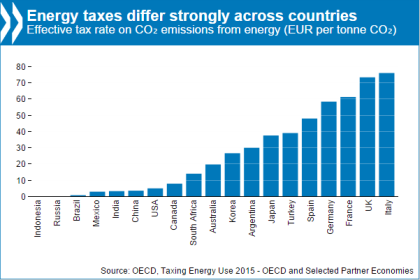

Economy-wide country tax rates on energy vary widely, from just over EUR 0 per tonne of CO2 to EUR 107.3 per tonne of CO₂, with significant differences between different fuels and uses, and within countries.

Taxes are particularly low, or zero, on some of the most harmful fuels, making them unduly appealing to end-users.

Coal, which contributes significantly to climate change and local air pollution, is the lowest and least frequently taxed fuel: 85% of coal used for heating and process purposes in the 41 countries is untaxed, and the average tax rate on coal is less than EUR 2 per tonne of CO₂

By comparison, oil products are taxed at EUR 49 per tonne of CO₂ on average, with the vast majority of oil products subject to energy taxes.

Taxes differ strongly among users, in ways that are not explained by differences in environmental impacts. They are much lower for heating and process fuels and the electricity sector than for transport; and they also differ between fuels used for the same purpose.

The simple average effective tax rate on energy use in the transport sector is EUR 70 per tonne of CO₂, against EUR 3 per tonne of CO₂ in heating and process use and in electricity production.

Thirty-nine countries tax diesel for transport use at lower rates than gasoline, despite the greater environmental harm from diesel use.

“The evidence presented in this report provides concrete suggestions for reform to make sure that taxes on energy use help achieve economic, social and environmental objectives more effectively,” Mr Gurría said.

Further information on Taxing Energy Use is available here:

An embeddable version of the report is available, together with information about downloadable and print versions of the report.

The report highlights country similarities and differences using innovative graphical formats. It presents graphical profiles of energy use and taxation in the seven partner countries. These complement the profiles for OECD countries presented in the 2013 Taxing Energy Use publication.