Modern Monetary Theory: Elixir or Illusion

By: Ken White

Free Money?

In the dismal science of economics, money is scarce, and we live on a budget. A new school of economics is emerging where money is only scarce for households and businesses but not for governments as they can print as much as they need.

This school is called the Modern Economic Theory.

On the surface, it seems wacky. But it is being taken very seriously in some circles. It may be behind the considerable pandemic-related government expenditures and deficits over the past three years.

The IMF states that in the first eight months of the pandemic, governments spent $12 trillion US dollars, and central banks created $7.5 trillion by QE.

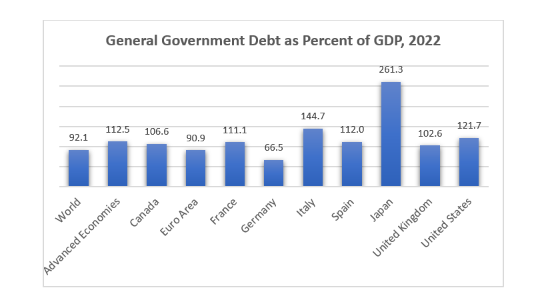

A quick look at debt-to-GDP levels in industrialized countries reveals a sea of debt and high deficit-to-GDP ratios. In this essay, I am digging deeper into the New Monetary Theory, comparing it to traditional Keynesian economics and revealing the weaknesses of this new school of endless debt and deficits.

Source: IMF Staff estimates and projections

Over the past three or four years, industrialized countries have been borrowing heavily, running high fiscal deficits, and hiking up inflation. Central banks, back then, contributed to the inflation “run up” by printing oodles of new money and maintaining almost zero interest rates.

When the inflation dragon started to roar, central banks almost immediately put on the breaks, hiking interest rates and stopping the money printing presses.

Governments, however, kept on spending and building up deficits. Inflation is slowing down but is still too high. The central banks’ efforts to slow the economy and stop inflation were less effective than planned. Governments are still overspending.

Modern Monetary Theory (MMT)

The “basic principle of Modern Monetary Theory (MMT) is seductive and simple: governments don’t have to budget like households, worrying about debt, because, unlike households, they can simply print their own money.”

There is no financial constraint on government spending.

MMT proponents argue that interest rates should be set near zero, which they believe is the “natural” rate. “Treasury debt could be eliminated if the central bank were to pay interest on reserves simply, or if the Fed were to adopt zero as its overnight interest rate target.”

This new policy may partly drive recent fiscal imbalances and high debt levels among industrialized economies, or is this behaviour of Keynesian economics getting out of control?

Traditional Economic Thinking

Traditional economists argue that the bigger the deficit, the more the government must borrow. This increased borrowing causes interest rates to go up. Private investment is stifled, and growth is choked off.

In industrialized economies, current account deficits finance a considerable portion of fiscal expenditures. These monies require an attractive return, especially from international investors; otherwise, investments would be crowded out. Government debt cannot grow without paying debt service costs.

Keynesian vs Modern Monetary Theory

MMT is opposed to traditional macroeconomics. MMT operates on the premise that government deficits do not impact interest rates. Money is created (through printing it).

MMT theorists believe Quantitative Easing (QE) to be only an asset swap. This drives up the price of the affected assets without creating new money and shifts government bonds into other equities, driving up prices and enhancing economic inequality. QE disproportionally benefits the wealthiest.

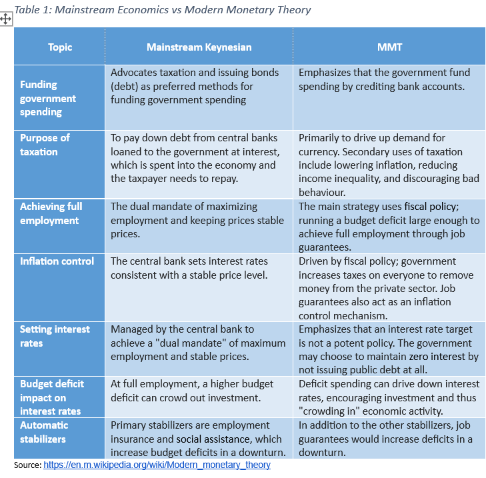

The MMT folks believe inflation is better controlled through government spending and taxation than hiking interest rates. This may look like Keynesian economics, but it is not. The following table shows the differences and similarities between MMT and Keynesian theories on managing the economy.

Flaws of Modern Monetary Theory

Traditional economists believe that MMT poses severe risks to those governments that employ this philosophy. These serious risks include:

- Unlimited spending doesn’t solve all economic problems. Inflation becomes a severe risk.

- Too much debt is a problem. A considerable deficit could result in and compromise lending and interest rates, which would increase inflation.

- Rising inflation – soaring interest rates often accompany high deficits with a risk of hyperinflation.

The Keynesian macroeconomic theory states that fiscal deficits financed by governments issuing bonds are viable for growing the economy when needed. But there are limits to increasing this debt, and fiscal policies must operate in tandem with monetary policies and central banks setting interest rates.

Fiscal policies in industrialized countries, including Canada, appear to operate under MMT principles partially; central bankers are not. The risk for this reckless behaviour includes continuing high deficits, high debt-to-GDP ratios and sticky inflation, which won’t disappear.

MMT theory is not an elixir. It is at least partly an illusion. MMT was influential in the short term during the pandemic. Still, those societies that practiced this philosophy are paying a high price through punitive interest rates and difficult-to-manage inflation.

Ken White is a semi-retired economist living in Port Coquitlam, British Columbia. His recent work has been modelling the economic impacts of the green economy and defence-related innovation. Also by Ken White The Bank of Canada – Is it Broke or Broken?