The Importance of Life Cycle Analysis

What is ESG Investing?

What is ESG Investing?

Environmental, Social, and Governance (“ESG”) investing is capturing the attention (and dollars) of more institutional investors each year, and it continues to grow exponentially.

The E in ESG, environmental criteria, includes the energy your company takes in and the waste it discharges.

S, social criteria address the relationships your company has and the reputation it fosters with people and institutions in the communities where you do business. S includes labour relations and diversity and inclusion.

G, governance, is the internal system of practices, controls, and procedures your company adopts to govern itself, make effective decisions, comply with the law, and meet the needs of external stakeholders. Every company, which is itself a legal creation, requires governance.

How does Life Cycle Analysis affect ESG Investing?

How can an ESG investor be sure that the investments it is making truly align with the values those funds purport to prioritize?

We know ESG investments are good for business. Companies that pay strong attention to environmental, social and governance concerns do not often experience lower value creation and profits. A highly credible ESG value

proposition often results in higher equity returns and higher credit ratings.

A “once over lightly” analysis for ESG impacts provides a misleading story. Ideally, carbon savings need to be assessed on a full life cycle basis that includes all intermediate goods and services (upstream) as well as downstream impacts.

These life cycle impacts are complicated and require intrinsic accounting procedures for the true carbon impacts to be known.

The study of environmental impacts for consumer products has a long history that dates back to the 1960s and 1970s. For many products, a large share of the environmental impacts is not in the use of the product, but in its production, transportation or disposal. Gradually, the importance of addressing the life cycle of a given product, or of several alternative products became an issue in the 1980s and 1990s. Out of this emerged the idea of life cycle assessments (LCA).

The scope of these studies was initially limited to energy analyses but was later broadened to encompass resource requirements, industrial emissions loading and waste.

The United States subsidizing corn ethanol production was associated with a fierce debate whether the production of corn ethanol including seeding, cropping, distribution and storage and ethanol production actually resulted in a

net energy increase over and above the energy (and carbon) associated with ethanol’s wheels-to-wheels production.

Virtually all biomass fuels whether it is wood chips used as hog fuel by a forest plant operation, ethanol from corn or biodiesel from oilseeds require energy in their production and carbon is burned through the upstream operations

Energy and carbon are also involved in downstream operations. The key issue is whether net emissions from the burning of biofuels on a cradle to grave basis are higher or lower than its fossil fuel alternative. This calculation is not often clear-cut; its carbon accounting is complicated, but without all the facts, we are operating in the dark.

Some companies through highly polished communications and public relations make it look like their products are greener than they really are. This is called “greenwashing”.

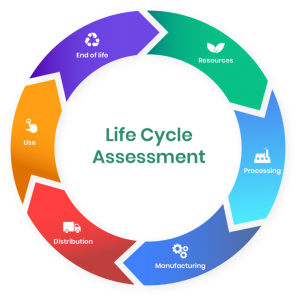

LCA is a standardized, science-based tool for measuring the impact and answering the simple question: How does my product or process affect the environment?

LCA measures the effect on the environment of a product, service, or process over its full life cycle. Carbon impacts are measured for the following stages:

Extraction of raw materials * Energy consumption * Manufacture * Transportation * Use * Recycling *Final disposal or end of life.

Figure 1: Life Cycle Stages

Figure 1: Life Cycle Stages

A Life-Cycle Assessment measures what happens before and after the final product is used over a long time period. A robust LCA of a construction product (or a building) includes the impacts of:

- Extraction of the relevant raw materials, e.g., quarrying, mining

- Refinement and conversion to process materials, e.g., steelmaking or cement production

- Manufacturing and packaging processes, e.g., steelwork fabrication or making precast concrete products

- Transportation and distribution between each stage

- Waste at each stage

- On-site construction impacts, e.g., water and energy use, temporary works, shuttering, worker commuting, etc.

- Operation during the lifetime of the building including maintenance, refurbishment, replacement, etc.

- At the end of its useful life, demolition, final transportation, waste treatment and disposal.

Rather than employing cradle-to-grave life cycle assessments from resource extraction (‘cradle’) to the use phase and disposal phase (‘grave’), sometimes builders conduct a cradle-to-gate assessment. Cradle-to-gate is an assessment of a partial product life cycle from resource extraction (cradle) to the factory gate (i.e., before it is transported to the consumer).

Cradle-to-cradle starts in the design phase where every piece of a product can retain value at the end of its current use cycle. “Real innovations that follow the cradle-to-cradle approach include buildings with roofs that can be used for farming, carpets that filter particles from the air and wall plaster that absorbs airborne toxins.”

Embodied carbon or carbon footprint assessment is a subset of most LCA studies.

The term ‘embodied carbon’ refers to the lifecycle of greenhouse gas emissions (expressed as carbon dioxide equivalents – CO2e) that occur during the manufacture and transport of construction materials and components, as well as the construction process itself and end-of-life aspects of the building. In recent years, the term ‘embodied carbon of construction materials and products has become synonymous with the term ‘carbon footprint’.

Environmental Product Declarations (EPD)

An Environmental Product Declaration (EPD) is an independently verified and registered document that communicates transparent and comparable information about the life-cycle environmental impact of products in a credible way.

EPD’s are used to provide environmental information from LCA studies in a common format, based on common rules. The construction industry has widely adopted EPD as the means of reporting and communicating environmental information.

Cradle-to-gate assessments are sometimes the basis for EPD’s. In these instances, the EDP declarations are omitting critical carbon impacts.

Conclusion

In conclusion, ESG investments potentially provide a strong and unique opportunity to both make money and to lower our carbon footprint. ESG investing is capturing the attention (and dollars) of an exponentially growing number of institutional investors. The key issue, however, is how can an ESG investor be sure that its investments are in alignment with environmental, social and governance values.

To this end, a credible life cycle analysis is a powerful and needed tool.

A full cradle-to-grave is preferable to a cradle-to-gate assessment. Cradle-to-cradle is even better.

Ken White is a semi-retired economist from Port Coquitlam, British Columbia. Ken has previously worked on energy-related issues both as an economist for the federal government, as an energy consultant for the National Research Council and the Privy Council Office of Canada and on numerous green energy projects.