Venture capital activity surges for first half of 2015

July 29, 2015 – Toronto, ON – Canada’s private capital community believes current economic conditions are favourable for investment, and yet venture capital and private equity activity are trending in different directions.

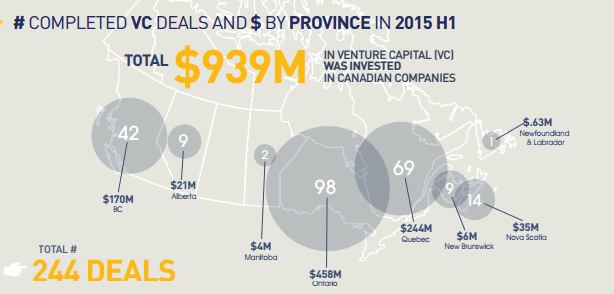

According to the Canadian Venture Capital & Private Equity Association (CVCA)’s 2015 half year (H1) market activity reports released today, venture capital was up significantly in terms of both deal activity and disbursement levels. 2015 H1 saw 244 venture capital completed deals, capturing $939 million – up 21 per cent and 23 per cent respectively over the same period last year.

Meanwhile, private equity saw a similar number of completed deals year over year (145 deals in 2015. H1 versus 147 deals in 2014 H1), however the amounts invested dropped significantly with deal value down from $11.4 billion in 2014 H1 to $7.8 billion in 2015 H1.

The surge in venture capital activity came in the second quarter of 2015 – the amount invested was up 53 per cent from the first quarter.

Life Sciences played a significant role with the sector more than doubling the amount invested from Q1 at $92 million to Q2 at $211 million.

Regionally, there were also massive spikes of VC activity in Q2. In British Columbia, deal activity grew by 123 percent quarter over quarter, and disbursement levels soared by almost 150 per cent. In Quebec, disbursements nearly tripled due to a surge in life sciences investments with two big deals driving growth (Clementia Pharmaceuticals, $73.9 million and Milestone Pharma, $20.9 million).

“A refreshed approach to venture capital in Canada, combined with recent successes and rising stars are creating a lot of market momentum,” said Mike Woollatt, CEO, CVCA.

“Private investment is leveraging public investment very well and they are working together to generate robust growth.”

The trend toward greater private capital deal activity is expected to continue. Data collected from a comprehensive survey of CVCA members in July 2015 showed that the vast majority (82 per cent) believe economic conditions favour the private capital industry, and 66 per cent believe a lower Canadian dollar improves the business outlook. As for possible exits, 60 per cent expect IPO and M&A activity will remain the same for the rest of 2015.

Highlights:

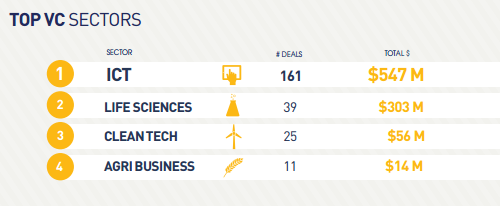

- 2015 H1 saw 244 disclosed VC deals with $939 million invested. ICT remains the sector leader capturing 161 deals and $547 million invested. Life sciences drives growth in VC, overall IPO and M&A activity expected to remain unchanged for remainder of year

- Highlights: 2015 H1 saw 244 disclosed VC deals with $939 million invested. ICT remains the sector leader capturing 161 deals and $547 million invested.

- Next top three sectors: Life Sciences accounted for 39 deals, capturing $303 million, followed by Clean Technology at 25 deals and $56 million invested, and then Agribusiness with 11 deals and $14 million invested.

- Top three regions: the majority of VC deal and investment activity took place in Ontario with 98 deals, capturing $458 million invested. Quebec was second largest with 69 deals and $244 million invested, followed by BC with 42 deals and $170 million invested.

- Top disclosed VC exit of 2015 H1: SkyWave Mobile Communications acquisition by ORBCOMM for $204 million. VC backers included McLean Watson Capital, Desjardins Venture Capital, and GTI Capital.

- Stage: seed and early stage disbursements in 2015 H1 accounted 58 percent of total disbursements, up from 46 percent recorded in 2014 (seed 78 deals for $65 million, early stage 79 deals for $484 million).

- Funds raised: 2015 H1 saw 19 funds raised for a total of $910 million, already reaching more than three-quarters of the total for 2014 ($1.2 billion). PRIVATE EQUITY:

- Click to view 2015 H1 PE market activity infographic

- Click to view the CVCA’s full 2015 H1 PE market activity report