Use fiscal initiatives to escape low-growth trap says OECD

Paris, 28 November 2016 – Expansionary fiscal initiatives and maintaining trade openness are needed to push the global economy out of today’s low-growth trap, according to the OECD’s latest Global Economic Outlook.

The global economy has the prospect of modestly higher growth, after five years of disappointingly weak outcomes,” OECD Secretary-General Angel Gurría said while launching the Outlook.

“In light of the current context of low interest rates, policymakers have a unique window of opportunity to make more active use of fiscal levers to boost growth and reduce inequality without compromising debt levels. We urge them to do so,” Mr Gurría said.

The Outlook projects that well targeted public spending initiatives could catalyse private economic activity and help to get the global economy out of the low-growth trap. The ongoing or projected shift in the fiscal stance in a number of major economies accounts for much of the modest increase in global growth to 3.3% in 2017 and 3.6% in 2018.

Among the major advanced economies, activity is expected to accelerate in the United States, due to an assumed easing of fiscal policy, with the economy projected to grow by 2.3% in 2017 and 3% in 2018. The euro area will grow at a 1.6% rate in 2017 and by 1.7% in 2018. In Japan, growth is projected at 1% in 2017 and 0.8% in 2018. The 35-country OECD area is projected to grow by 2% in 2017 and 2.3% in 2018, according to the Outlook.

Canada’s Outlook is Promising

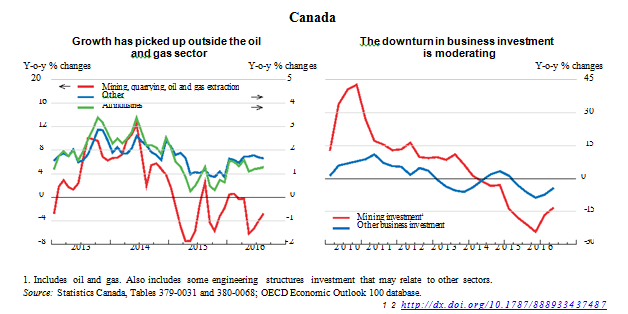

In Canada economic growth is projected to increase to 2.3% in 2018. As contraction in the resources sector slows, activity in the rest of the economy is projected to strengthen.

Non-energy exports should continue to benefit from stronger export market growth and earlier exchange rate depreciation. Consumer price inflation should pick up to around 2% as the effect of falling energy prices fades and excess capacity is gradually eliminated.

The contraction of energy investment has slowed and should be nearly complete by the end of the year, at which time cumulative losses will have reached about 60% since 2014. Similarly, exports and other business investment are turning up, supported by gains in export competitiveness, a strengthening US economy and growing capacity constraints.

Read the full Canadian Economic Forecast here

Rest of World

With rebalancing continuing in China, growth is expected to continue drifting lower, to 6.4% in 2017 and 6.1% in 2018. India’s growth rates are expected to hover above 7.5% over the 2017-18 period, but many emerging market economies will continue to grow at a more sluggish pace. The deep recession in Brazil is expected to end in 2017, after which the economy will grow at a 1.2% rate in 2018.

The Outlook draws attention to conditions that create a “window of opportunity” for new fiscal initiatives, as extraordinarily accommodative monetary policy has led to very low interest rates and created fiscal space.

A targeted annual increase in public spending of ½ percent of GDP could be financed for several years in most countries without increasing the debt-to-GDP ratio in the medium term. Combining this initiative with structural reforms, and acting collectively across countries, would boost the impact, according to the Outlook.

“This is not a blank cheque for governments,” Mr Gurría said. “The OECD is calling for fiscal policy to be used more wisely, with spending targeted at areas that boost growth, like high-quality infrastructure investment, innovation, education and skills, which also make growth more inclusive.”

Good Governance and Climate Change

The report notes that strong institutions and effective public governance are key for a successful fiscal initiative. This includes respect for the rule of law, quality regulation, transparency, openness and integrity.

“Whole-of-government approaches will improve outcomes and enhance the use of public resources. Fiscal policy is intertwined with a lot of other public policies – like competitiveness, climate-change mitigation, managing demographic change and innovation – and their effective combination can bring about synergies.”

Risks

The Outlook identifies a number of financial risks where exchange rate and capital flow volatility coupled with pricing distortions are exposing the vulnerability of corporate balance sheets, particularly in emerging markets, and challenging bank profitability and the long-term stability of pension schemes in advanced economies.

An increase in protectionism could risk impairing already weak growth in global trade.

“Protectionism and the inevitable trade retaliation would offset much of the positive effects of proposed fiscal initiatives on domestic and global growth,” said OECD Chief Economist Catherine L. Mann. “It would also likely raise prices, harm living standards and leave countries in a worsened fiscal position. Trade protectionism may shelter some jobs, but it will worsen prospects and lower well-being for many others.”

The Outlook calls on governments to avoid protectionist policies and encourages them instead to implement structural policy packages that create more job opportunities, increase business dynamism and promote successful reallocation, ensuring that the gains from trade are better shared by all.

For more information on the Economic Outlook, see: www.oecd.org/eco/outlook/economic-outlook/.