Counting the Cost of Energy Subsidies

Energy subsidies are projected at US$5.3 trillion in 2015, or 6.5 percent of global GDP, according to a recent IMF study. Most of this arises from countries setting energy taxes below levels that fully reflect the environmental damage associated with energy consumption.

The country-level estimates underlying these global figures are now publicly available.

Energy subsidies are substantial

Energy subsidies are dramatically higher than previously thought. Estimates for global energy subsidies in 2011 have been revised to US$4.2 trillion, more than double the US$2.0 trillion previously reported in a 2013 IMF book, Energy Subsidy Reform: Lessons and Implications.

The upward revision is partly due to factoring in new World Health Organization estimates on harm to health from pollution exposure. Additional country-level data on emissions and the damage they cause have also become available, as detailed in a more recent IMF book, Getting Energy Prices Right: From Principle to Practice.

Subsidies are projected to remain high, despite sharp declines in international energy prices. The estimate for 2015 is US$5.3 trillion (6.5 percent of global GDP). High growth in energy consumption, especially coal, inflation and real income growth, and persistent undercharging for environmental costs are all key factors.

Subsidies are pervasive

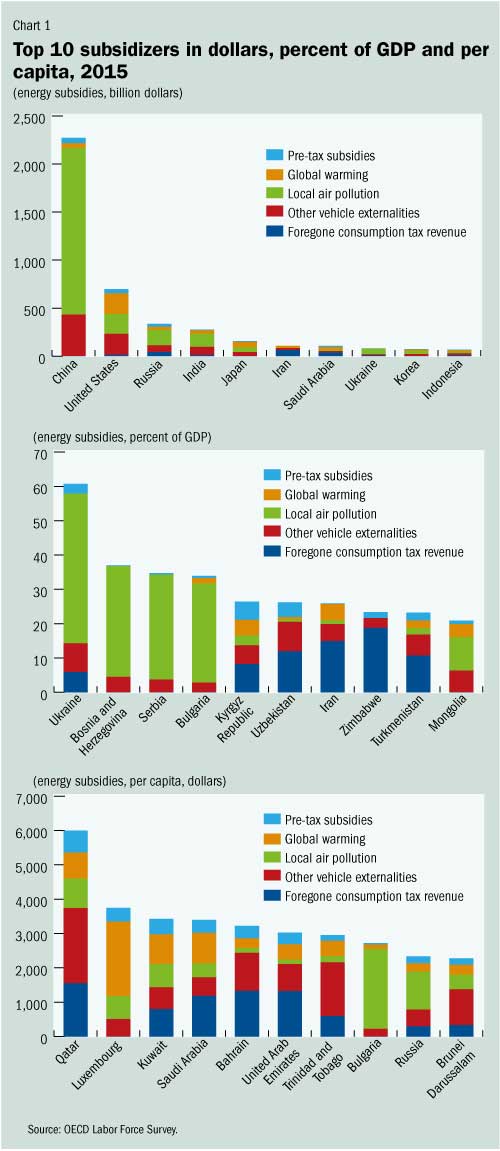

Energy subsidies are sizable in nearly all countries, advanced and developing economies alike. China is the top subsidizer in dollar terms, Ukraine in percent of GDP and Qatar in per capita subsidies (Chart 1). Subsidies in dollar terms in part reflect the size of the economy.

The bulk of energy subsidies in most countries are due to undercharging for domestic environmental damage, including local air pollution

The bulk of energy subsidies in most countries are due to undercharging for domestic environmental damage, including local air pollution—especially in countries with high coal use and high population exposure to emissions—and broader externalities from vehicle use like traffic congestion and accidents.

In many top subsidizers in percent of GDP and in per capita terms, these also reflect the setting of domestic energy prices below their supply cost.

The reform gains are large

Eliminating global energy subsidies could reduce deaths related to fossil-fuel emissions by over 50 percent and fossil-fuel related carbon emissions by over 20 percent.

The revenue gain from eliminating energy subsidies is projected to be US$2.9 trillion (3.6 percent of global GDP) in 2015. This offers huge potential for reducing other taxes or strengthening revenue bases in countries where large informal sector constrains broader fiscal instruments.

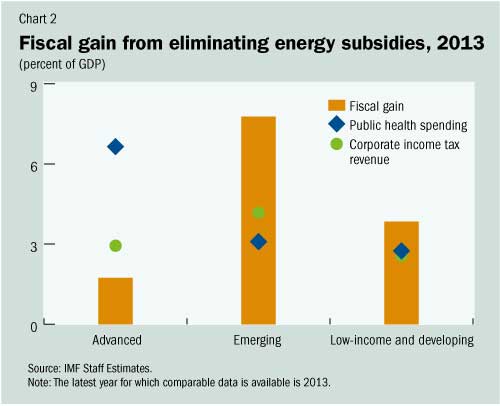

Advanced economies would gain enough revenue to halve corporate income tax or cover one quarter of public health spending

Advanced economies would gain enough revenue to halve corporate income tax or cover one quarter of public health spending (Chart 2). In emerging economies, the revenue is worth double their corporate income tax revenues or public health spending. In low-income countries, it is about one and half times corporate income tax revenues or public health spending.

The net gain from reform, after subtracting the cost of higher energy prices to consumers from the fiscal and environmental gains, is projected at US$1.8 trillion (2.2 percent of global GDP) and could be much larger if the fiscal gain is used for growth-enhancing tax cuts on labor and capital or badly needed investments in education, health, and infrastructure.

Your reform, your benefit

It is generally in countries’ own interest to move ahead unilaterally with energy subsidy reform. Top subsidizers in percent of GDP and in per capita subsidies stand to gain the most. The benefits will mostly accrue at the local level, by reducing local pollution and generating much needed revenues. Taxing fuels to reflect environmental costs is also straightforward administratively, as it can build off road fuel excises which are well established in most countries.

Energy subsidy reform can also contribute to carbon emissions reduction and help countries make pledges ahead of the Paris 2015 UN climate conference

Energy subsidy reform can also contribute to carbon emissions reduction and help countries make pledges ahead of the Paris 2015 UN climate conference. To achieve significant carbon emissions cuts at the global level, it would be essential for top subsidizers in dollar terms to play a leading role.

Low international energy prices have opened a window of opportunity for countries to move towards more efficient pricing of energy. However, a gradual approach may be desirable, given the size of the required price increases and uncertainty around the optimum level of taxes on negative externalities. This would allow time to further refine estimates, for households and firms to adjust, and for governments to implement measures to protect the poor.