Green Bond Market Maturing – Quarterly Update

By Tess Olsen-Rong, Climate Bonds Market Analyst

The first three months of 2015 (Q1) have seen 44 green bond deals totalling $7.2bn of issuance. After relatively low issuance in January the amount of green bonds issued has been climbing each month, with March three times bigger than January. This year will be the biggest year ever for green bonds: there’s a healthy pipeline of bonds in the works and we expect Q3 and Q4 in particular to be strong in the lead up to the UN COP.

From a slow Q1 2015 start green bond issuance is climbing

The big story in Q1 was the growing interest in green bonds in emerging markets shown by the increasing commentary on potential green bonds from the Middle East, China and South Asia. However, it was India who made the headlines, with the first Indian green bond issued in February.

The US municipal green bond market continued to grow with water and green buildings dominating the use of proceeds. One big difference between US municipal green bonds and other green bonds, however, is the low uptake in second opinions: none of the Q1 green muni issuances chose to get a second opinion.

Finally, if you think the role of the development banks in the green bonds is petering out, think again! In addition to contributing with benchmark issuances, many are increasingly supporting the green bond market through more specialised issuances in different currencies and structures, as well as on the investment side of the market.

Emerging markets: India’s first two green bonds, beating China to the punch

Low-carbon and climate resilient finance needs to grow fast in emerging markets with huge levels of investment required by 2050. The good news is that green bonds offer a potential solution. We had thought that China would be first of the largest emerging economies to enter the green bond market, but India beat them to the punch with a corporate green bond from Yes Bank. The INR 10bn ($161.5m) bond will finance renewable energy projects.

Hot on the heels of Yes Bank was the Export Import Bank of India, with a larger $500m green bond. The bond will finance renewable energy and low carbon transport projects – although not in India, but in neighbouring Bangladesh and Sri Lanka.

Policy support for the low-carbon transition may have been influential in encouraging these Indian green bonds: India has a target of creating 165 gigawatts of new renewables by 2022. According to Yes Bank, $70bn of debt investment is required to achieve this goal – meaning ample opportunities for green bonds! After some lobbying, the Indian government has become supportive of the use of green bonds as a tool to meet India’s green financing needs; they have apparently been asking India n Government agencies and development banks to start issuing green bonds. Expect to see more of green bonds out of India this year.

But let’s not forget about China. We now expect the first Chinese green bond mid-year, heralding a rush of green issuance.

Currency diversity allows more investors to gain exposure in green bonds

Green bonds need to be available in a range of currencies to give a wide range of investors the opportunity to invest. The bulk of green issuance continues to be in USD and EUR, but the development banks have been increasingly issuing smaller green bonds in a range of currencies including Turkish Lira, Brazilian Reals and Indian Rupees — in Q1 green bonds were issued in 11 different currencies.

Australian investors were also able to buy the KfW’s Kangaroo green bond in local Aussie dollars, which proved incredibly popular. Outside of the development banks, some corporates also appealed to local investors, such as the Wallenstam and Vasakronan green bonds in Swedish Kronor. Creating a deep and liquid green bond market requires currency diversity and in the past three months we’ve started to see that.

Green bonds were issued across 11 different currencies in Q1 2015 showing the growing depth in the market – however the USD and EUR issuance continued to dominate

.png)

Non-investment grade: Greater diversity as green bonds move down the ratings

We’ve also seen more high-yield bonds in the market — another important indicator of depth. Two of the largest green bonds (Terraform’s and Paprec’s) in the first quarter were non-investment grade; and they came from different types of issuers, respectively a yieldco and a corporate.

Terraform Power Operating (BB-) yieldco hit the market early in January with a sizeable $800m green bond to finance the acquisition of renewable energy assets. The bond followed the successful yieldco green bonds last year from NRG Yield and Abengoa Greenfield. French recycling company Paprec then issued its inaugural bond; a whopping (EUR 480m) $523m bond split across two tranches of EUR 185m/$201m (B-) and EUR 295/$321 (B+).

Four US states saw green bond issuance during Q1: Washington (Tacoma), Massachusetts, Arizona and Indiana. Proceeds from the green muni bonds are funding a wide range of projects, but are mainly centred on clean water and low-carbon buildings.

The State of Indiana joined Chicago and Iowa in issuing a green water bond; in fact, they did two separate green water bonds within a month. Now, the green credentials of a water bond can be a tricky subject: for example, if the investments funded involve long-term water infrastructure, has exposure to physical climate change impacts and the necessary adaptation measures been accounted for?

What is the energy intensity, and therefore emissions impact, of the water infrastructure (this can be very high)? Clean water provision that involves building infrastructure that ignores expected changes to rainfall patterns and intensity is frankly foolish – yet still all-too common. Ditto investments that rely on increased energy when other options are available, like demand management.

To be confident a water investment will deliver positive environmental benefits, investors need to have access to this kind of information. We saw an important recognition of this issue in the recent update of the Green Bond Principles when the water category was changed from ‘clean and drinking’ water to ‘sustainable’ water. Now we need more detailed criteria and an independent review model breaking into the green water municipal markets.

There’s also a growing trend amongst US universities to follow in the footsteps of MIT in refinancing their low-carbon buildings through green bond issuance. This quarter, both the University of Virginia and Arizona State University jumped on the bandwagon with a $97.7m and $182m issuance, respectively. Great news – but similar to the green muni water bonds, we‘d like to see an independent review of these bonds or at least a commitment to improve and report on the buildings’ energy efficiency during the tenor of the bonds.

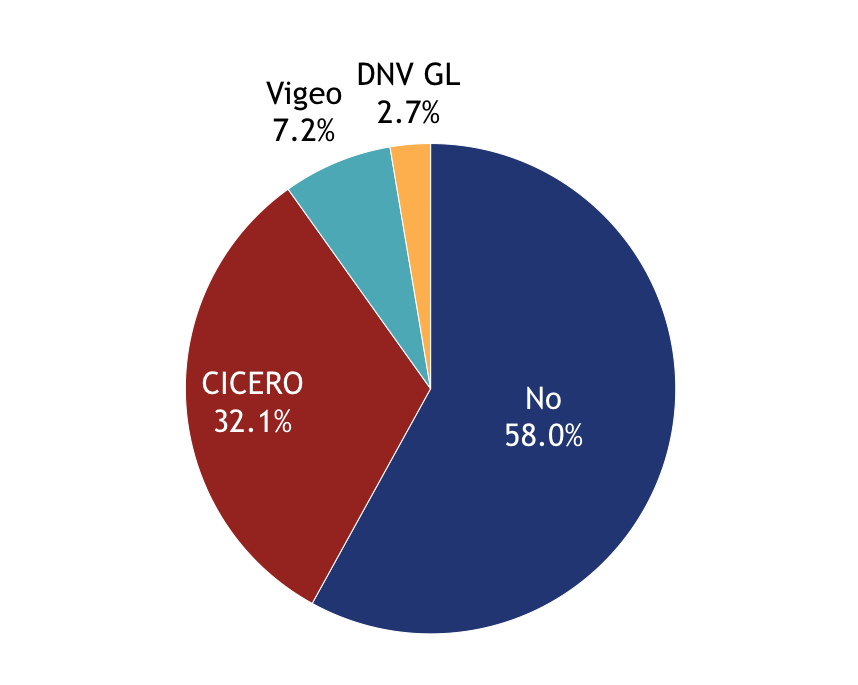

US munis have tended to avoid independent review, and their dominance in Q1, along with some un-reviewed Indian issuance, has meant more than half the Q1 bonds were un-reviewed

Development banks have continued to hold their dominant market position in Q1 2015. They maintained a 46.2% share of total issuance – the same as their 2014 share. Development banks continue to be green bond pioneers, and are now finding ways to support the market other than simply issuing large USD denominated green bonds.

For example, this quarter KfW – already a repeat green bond issuer – announced it would also participate in the market on the asset side of the business and invest in a broad range of green bonds through a EUR 1bn green bond portfolio. Similarly, IFC, the private sector arm of the World Bank, supported emerging market issuance bycommitting $50m of cornerstone investment to India’s first gree n bond from Yes Bank.

Q1 2015 green bonds have been issued by a variety of types of issuers

.jpg)

The development banks are pushing the envelope on green bond processes as well; for example, the EIB launchedan upgraded green bond impact report in late March.

Development bank reporting practices, however, are costly. Lower costs will be needed for the corporate green bond sector to grow, plus some levels of disclosure are difficult, such as when a bank is including in it’s green bond pool syndicated loans that are subject to confidentiality clauses in the syndication contracts. We believe that clear standards around green assets and around reporting methodologies, combined with audit-style certification, can keep the cost of verification suitably low while still providing confidence in the green credentials of a bond.

Energy and low-carbon buildings account for the largest share of use of proceeds of Q1 green bonds

To provide an indication of the types of projects to be financed by the Q1 2015 crop of green bonds we split the proceeds of each issuance into the declared eligible green project categories and pooled together. On first glance it shows that renewable energy is the biggest proportion, with the top three biggest bonds of the quarter — Terraform Power Operating, World Bank and Vestas — all financing renewables.

Proceeds from Q1 2015 green bond issuance have gone to a range of project types

Investor interest in green bonds remains high, even as they become more vocal on expectations of green

It’s no surprise to close followers of the green bond market that the investor appetite for green bonds has continued in Q1 2015.

This shows through in the upsizing of green bonds as a result of strong demand –the World Bank’s retail green bond in January, for example, was upsized from $15 to $91m; KfW’s kanga green bond intended to be AUD 300m ended up ballooning to AUD 600m; and Yes Bank doubled its green offering from INR 5bn to INR 10bn ($161.5m).

Another indicator is the continued high levels of oversubscription. An example from Q1 is the latest Kommunalbanken Norway’s (KBN) green bond issued in March, which received $700m orders for a $500m issue. Of course, oversubscription is a common feature of bond issuances generally in the current market environment; but green bonds seem to be seeing higher rates of oversubscription than non-green ones.

A more diverse set of investors are getting involved in the green bond market. There have been many public commitments over the quarter to invest in green bonds including €1bn from Deutsche Bank treasury – in addition to the mentioned EUR 1bn commitment from KfW.

The number of green bond funds/mandates are also growing: during the first quarter Swedish insurance company SPP announced a green bond fund following in the footsteps of Nikko Asset Management, BlackRock, State Street, Calvert and Shelton Capital Management. Plus Norwegian investment powerhouse Norges Bank Investment Management (with over $800bn of assets under management) also disclosed it has established a green bonds mandate.

Investors are also becoming more involved in structuring green bond products to fit their specific requirements. For example, the World Bank issued a green bond with longer tenor of 30year ($34m) specifically for Zurich Insurance, who wanted to match long-term liabilities with a green bond. Partnerships such as this will be important as demonstration issuances to show off green bonds in new markets.

Another development is the launch of an investor statement of expectations for the green bond market from a group of key green bond investors, brought together by Ceres Investor Network on Climate Risk. The investors’ main ask is for greater transparency and reporting, especially quantitative reporting where possible, on the green credentials and impacts of green bonds.

The report states: “this will minimise ‘greenwash’ concerns and reputation risk to issuers and investors”. The 26 signatory investors are: Addenda Capital, Allianz SE, AXA Group & AXA IM, BlackRock, Boston Common AM, Breckinridge, CalPERS, CalSTRS, Colonial First State, Community Capital Management, Connecticut Retirement Plans, Retirement System of the State of Rhode Island, Everence, Mirova, NY State Comptroller Thomas P. DiNapoli, North Carolina Retirement System, Pax World Investments, PIMCO, RBC Global Asset Management, Standish Mellon Asset Management, California State Treasurer John Chiang, Trillium Asset Management, UN Joint Staff Pension Fund, University of California, Walden Asset Management and Zurich Insurance.

There was $60bn of green bonds outstanding at the end of March 2015

.png)

![]() More details on this Quarterly Update and on the Climate Bonds Initiative are available here.

More details on this Quarterly Update and on the Climate Bonds Initiative are available here.

.PNG)